Explore the Benefits of IoT Integration in Financial Services

In today’s rapidly evolving digital world, the integration of Internet of Things (IoT) technology has become increasingly present across various industries. One sector that stands to gain significant advantages from IoT integration is financial services. Properly utilizing the power of IoT devices and data analytics, financial institutions can revolutionize the way they operate, enhance customer experiences, and drive innovation. In this blog post, we’ll delve into the key benefits of IoT integration in financial services and explore how it is reshaping the industry.

Enhanced Customer Experience

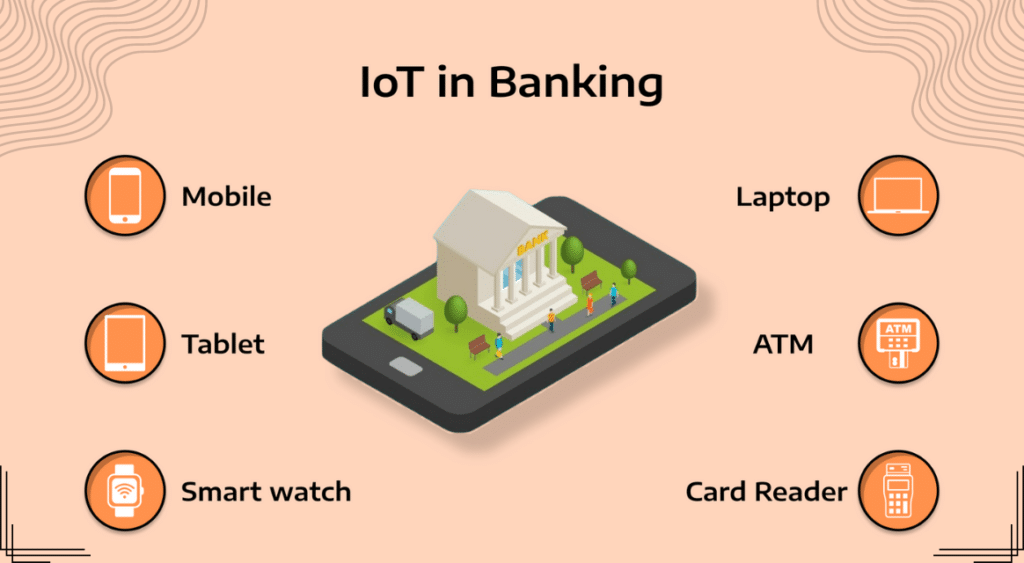

IoT integration enables financial institutions to offer personalized and proactive services to their customers. By leveraging IoT devices such as wearables, smart sensors, and mobile apps, banks can gather real-time data on customer behavior, preferences, and transactions. This data can be analyzed to tailor product offerings, provide personalized recommendations, and deliver targeted marketing campaigns, ultimately enhancing customer satisfaction and loyalty.

Improved Operational Efficiency

IoT devices can streamline and automate various operational processes within financial institutions, leading to improved efficiency and cost savings. For example, IoT-enabled sensors can monitor and manage the performance of ATMs, branch locations, and other infrastructure in real time, allowing for predictive maintenance and minimizing downtime. Additionally, IoT integration can optimize resource allocation, reduce manual tasks, and enhance workflow automation, freeing up employees to focus on higher-value tasks.

Enhanced Security and Fraud Prevention

IoT technology can bolster security measures within the financial services sector, helping to prevent fraud and mitigate risks. Through the use of biometric authentication, sanction screening, geolocation tracking, and behavioral analytics, banks can enhance identity verification processes and detect suspicious activities in real-time. naztech is keen to integrate all these capabilities into the latest Fintech solutions. IoT devices can also monitor physical security measures, such as surveillance cameras and access control systems, to ensure the safety of sensitive assets and data.

Data-Driven Insights and Decision-Making

By leveraging IoT-generated data, financial institutions can gain valuable insights into customer behavior, market trends, and operational performance. Advanced analytics tools can process and analyze vast amounts of IoT data in real-time, providing actionable insights that drive informed decision-making and strategic planning. From identifying new revenue opportunities to optimizing risk management strategies, IoT integration empowers financial institutions to stay agile and competitive in a rapidly changing market.

Innovative Product Offerings

IoT integration opens up opportunities for financial institutions to develop innovative product offerings and services that meet the evolving needs of customers. For example, banks can leverage IoT technology to offer usage-based insurance, personalized wealth management solutions, and smart payment solutions. By embracing IoT-driven innovation, financial institutions can differentiate themselves in the market and attract new customers while retaining existing ones.

Final Words

In conclusion, we can say the integration of IoT technology in financial services offers a wealth of benefits, ranging from enhanced customer experiences and operational efficiency to improved security and innovative product offerings. As the financial services industry continues to embrace digital transformation, IoT integration will play an increasingly vital role in driving growth, fostering innovation, and shaping the future of banking and finance. naztech has included some of these capabilities in the latest Fintech solutions.