The Importance of Data Security and Governance in Robust FinTech Solutions

In today’s fast-paced digital world, financial institutions face challenges in protecting sensitive data while maintaining regulatory compliance. With the rise of cyber threats and tight regulations, ensuring robust data security and governance has become highly important for the success and trustworthiness of FinTech solutions. At naztech, we recognize these challenges and have developed cutting-edge solutions. In this blog post, we highlighted the importance of cyber security from the perspective of naztech FinTech Solutions and demonstrated how the issues are addressed in our FinTech solutions, including xSCREEN, xTRANSACT, and xSMART.

Key Issues of Data Security and Governance in FinTech Solutions

In the rapidly evolving landscape of financial technology, data security, and governance emerge as critical for ensuring trust, integrity, and regulatory compliance. As FinTech solutions continue to revolutionize the way we transact and manage financial data, it is essential to address key issues surrounding data security and governance to mitigate risks and foster innovation responsibly. Following are the key Issues of Data Security and Governance in FinTech Solutions.

Cybersecurity Threats:

Cybersecurity threats pose one of the most significant challenges to data security in FinTech. With the proliferation of sophisticated cyber-attacks targeting financial institutions and their customers, safeguarding sensitive data from breaches, ransomware, and malicious actors remains a top priority. Robust FinTech solutions must employ sophisticated encryption techniques, multi-factor authentication, and continuous monitoring to detect and mitigate cyber threats effectively.

Regulatory Compliance:

The regulatory landscape governing data security and privacy in FinTech is complex and constantly evolving. Financial institutions need to navigate a lot of regulations, including GDPR, CCPA, PCI DSS, and various industry-specific compliance standards. Ensuring compliance with these regulations requires a thorough understanding of legal requirements, proactive risk management strategies, and ongoing monitoring and reporting mechanisms.

Data Privacy and Consent:

Protecting customer data privacy and ensuring compliance with data protection laws are paramount in FinTech solutions. Transparency and user consent are essential elements of data governance, requiring clear communication of data collection practices, purpose limitation, and explicit consent mechanisms. FinTech companies must prioritize data minimization, anonymization, and secure storage practices to uphold user privacy rights and build trust with customers.

Third-Party Risk Management:

Many FinTech solutions rely on third-party vendors and service providers to deliver core functionalities, introducing additional risks to data security and governance. Managing third-party risks requires robust due diligence processes, vendor assessments, and contractual agreements that define security requirements and responsibilities. Continuous monitoring of third-party activities and compliance with contractual obligations is essential to mitigate the risk of data breaches and ensure regulatory compliance.

Insider Threats:

Insider threats, whether intentional or accidental, present significant challenges to data security and governance in FinTech. Employees, contractors, and partners with access to sensitive data pose a risk of unauthorized access, data theft, or inadvertent disclosure. Implementing access controls, user training programs and privileged access management solutions can help mitigate insider threats and enforce data security policies effectively.

Importance of Addressing Key Security Issues in FinTech Solutions

Addressing the key issues of data security and governance is essential for the continued growth and success of FinTech solutions. By prioritizing cybersecurity, regulatory compliance, data privacy, third-party risk management, and insider threat mitigation, financial institutions can build resilient and trustworthy FinTech ecosystems that empower innovation while safeguarding sensitive data and maintaining the trust of customers and stakeholders.

Enhancing Sanction Screening Efficiency with xSCREEN

Sanction screening is a critical component of financial compliance, aimed at identifying and preventing transactions involving sanctioned individuals or entities. However, manual screening processes are often time-consuming and prone to errors. With xSCREEN, naztech revolutionizes sanction screening by leveraging advanced algorithms and machine learning to automate the process. By continuously monitoring transactions in real-time against global sanction lists, xSCREEN ensures swift and accurate identification of potential risks, enabling financial institutions to mitigate compliance breaches effectively.

Ensuring Secure Transaction Monitoring with xTRANSACT

The integrity of financial transactions is paramount to maintaining trust and credibility in the financial ecosystem. xTRANSACT provides financial institutions with a comprehensive solution for secure transaction monitoring, utilizing state-of-the-art encryption techniques and real-time transaction analysis. By detecting anomalies and suspicious activities promptly, xTRANSACT empowers institutions to proactively prevent fraudulent transactions and safeguard their customers’ assets.

Facilitating Secure SWIFT Messaging by Using xSMART

Swift messaging is the backbone of global financial communication, facilitating the seamless exchange of critical information among banks worldwide. However, ensuring the confidentiality and integrity of SWIFT messages is a constant challenge, given the evolving threat landscape. explore xSMART – naztech’s innovative solution for secure SWIFT messaging. By implementing robust encryption protocols and access controls, xSMART ensures the confidentiality, integrity, and authenticity of SWIFT messages, thereby fortifying the backbone of global financial transactions against cyber threats and unauthorized access.

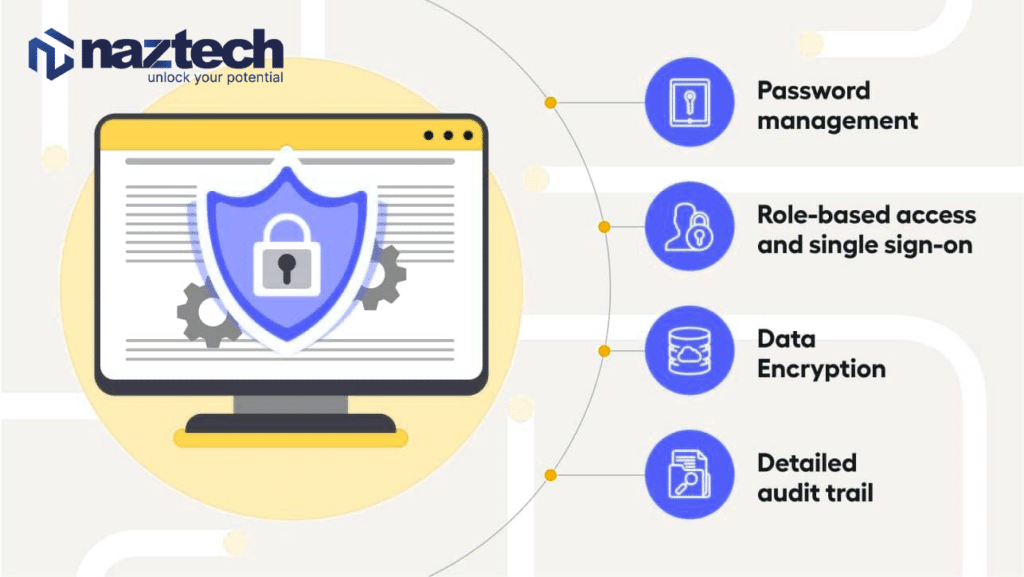

Data Security and Governance in naztech Solutions

At naztech, our FinTech solutions are not only high-performing but also prioritize data security and governance at their core. We adhere to the highest standards of data protection, implementing stringent security measures and regulatory compliance frameworks to safeguard sensitive information. Our commitment to excellence extends beyond technological innovation to encompass the trust and confidence of our clients and partners in the integrity and reliability of our solutions.

Final Words

Finally, we need to be aware of the importance of data security and governance and it cannot be overstated in the FinTech Industry. By leveraging advanced technologies and robust frameworks, naztech’s key FinTech solutions such as xSCREEN, xTRANSACT, and xSMART empower financial institutions to navigate regulatory complexities with confidence while safeguarding against emerging cyber threats. As the financial landscape continues to evolve, naztech remains at the forefront, delivering innovative solutions that redefine the standards of data security and governance in FinTech.

Top of Form