The Role of Machine Learning in Enhancing Anti-Money Laundering (AML) Efforts

It is no longer sufficient to fight money laundering using conventional tactics in a world where financial crime is changing at an accelerated rate. Machine learning (ML) is a revolutionary tool in the fight against financial crime. Financial institutions use machine learning (ML) to remain ahead of the game as money launderers create more intricate strategies to hide their unlawful activities

Increasing Risk of Money Laundering

The UN estimates that between $800 billion and $2 trillion is laundered annually, or 2-5% of the global GDP, making money laundering a persistent threat worldwide. Authorities only find roughly 1% of these illicit monies, despite the enormity of the problem. The number of financial transactions and the growing sophistication of laundering tactics pose a formidable challenge to regulatory bodies and financial institutions (FIs).

Source: kpmg.com

Why Traditional AML Approaches Are Falling Short

Traditionally the most common approach to Anti-Money Laundering (AML) is the rule-based system for flagging suspicious transactions. With the increasing development in data complexity in today’s transaction systems, these approaches were accepted, but they eventually caused these systems to become overburdened. Due to the high rate of false positives, there are missed opportunities to apprehend the real offenders, and resources are squandered.

Furthermore, money launderers are improving at finding loopholes to get around these regulations by taking advantage of weaknesses and applying sophisticated strategies like layering and structuring. A more dynamic and adaptable strategy is required in this quickly changing environment, and machine learning can help with that

Machine Learning: A Revolutionary Approach to AML

With their sophisticated algorithms, machine learning techniques revolutionize the processing of large amounts of data and can identify patterns, a task that took a long time for human analysts to do in the old system.

Unlike traditional systems, ML can adapt to emerging patterns and anomalies in real time, significantly enhancing the accuracy of suspicious activity detection. Financial institutions that have adopted ML technologies report improvements of up to 40% in identifying suspicious activities and a 30% increase in operational efficiency.

These are the few significant ways in which machine learning is transforming the AML game –

Reduction in False Positives

One of the most common and fatal issues in AML is the large amount of false positive result generation with the traditional system. To address this issue, ML algorithms have shown significant results in reducing false alarms and allowing compliance teams to focus on genuine threats.

Anomaly Detection

ML models are well-known for identifying abnormalities in existing patterns, widely known as anomaly detection. Identifying unusual patterns in transaction behavior is one of the effective ways to identify money laundering. This ability to detect anomalies is crucial in identifying new and emerging forms of financial crime.

Advanced Customer Profiling

For effective risk profiling, analyzing a customer’s transaction history and behavior patterns, using ML models can provide significant success. This can help the financial institutions indicate the high-risk transactions and the customers.

Real-Time Monitoring

ML-powered systems flag transactions based on behavioral patterns and monitor real-time transactions so financial institutions can immediately act against potential money laundering activities.

Unsettling Patterns in Money Laundering: The Critical Role of Machine Learning

Combating financial crime requires evolving techniques that keep up with its evolution. Financial institutions must invest in machine learning (ML) infrastructure and regularly update their models with the most recent data to maximize Anti-Money Laundering (AML) efforts. To provide a framework that permits the use of ML while guaranteeing adherence to privacy and security regulations, regulatory bodies must collaborate closely with these organizations.

More complex AML solutions are needed now more than ever, particularly in light of the COVID-19 pandemic’s heightened financial crime and the growing popularity of cryptocurrencies. The increasing prevalence of synthetic identities—false identities made up of a combination of authentic and fraudulent data—also presents a serious problem that is difficult for conventional approaches to solve. ML’s ability to analyze large data sets and detect subtle trends makes it uniquely capable of tackling these emerging threats, helping financial institutions stay ahead of criminals and safeguard the global financial system.

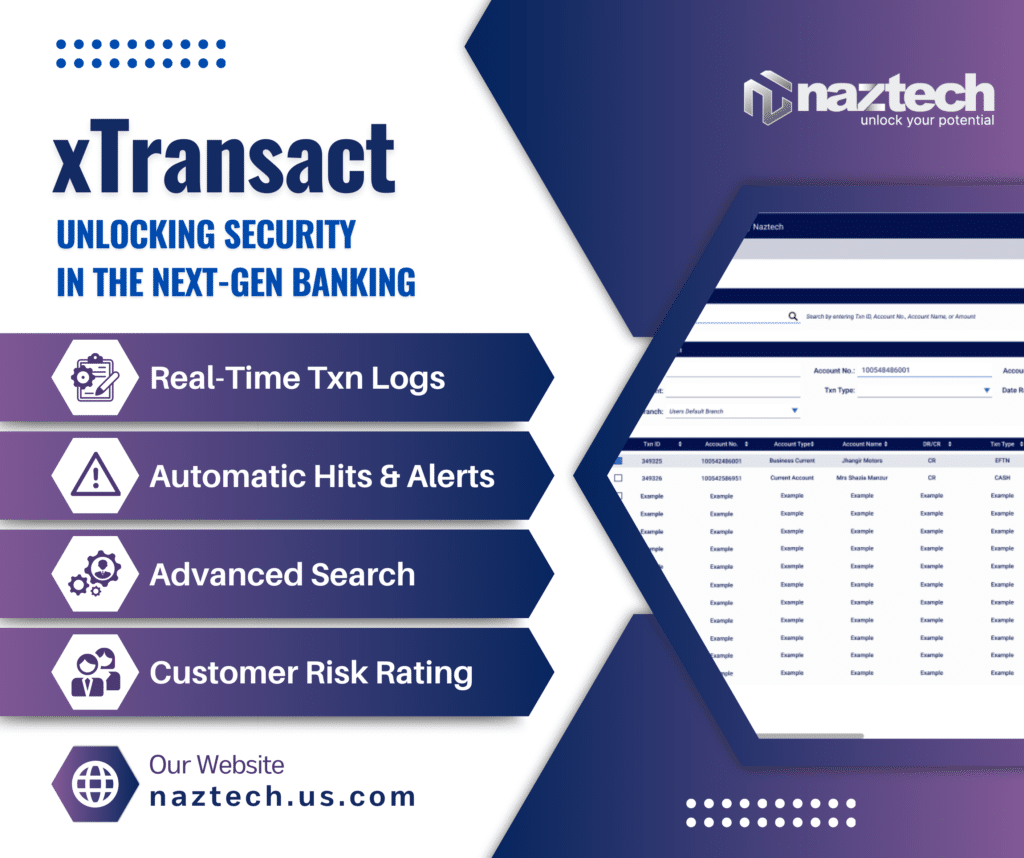

The Future of AML with naztech xTransact

Modern technologies like naztech’s xTRANSACT are essential to the future of Anti-Money Laundering (AML) as the financial landscape grows more complex. This cutting-edge transaction monitoring solution uses artificial intelligence (AI) to drive risk analysis, automation, and real-time screening to rethink AML completely. The automatic data analysis feature of xTRANSACT minimizes the inefficiencies associated with human processing, allowing institutions to process large numbers of transactions quickly and accurately. Its real-time screening features ensure that possible risks are found and eliminated immediately, instead of being discovered afterward. Furthermore, xTRANSACT’s AI learning feature enables it to adapt to new threats and keep working even when criminal strategies change quickly. xTRANSACT is a game-changing solution for combating fraudsters.