Unlock the Power of Potential Data Sharing with Blockchain Secure Financial Transactions

Unlock the Power of Potential Data Sharing with Blockchain Secure Financial Transactions

Title: Unlock the Power of Potential Data Sharing with Blockchain Secure Financial Transactions

Introduction:

In this era of digital transformation, few technologies have captured the world’s attention. Blockchain technology is one of them that is dominating the current distributed computational landscape. It has given the promise of security, transparency, and efficiency, which have empowered the distributed computing industries, especially in the financial sector. It has emerged as a game-changer in secure mass transactions. At naztech, we are harnessing the immense potential of blockchain to revolutionize the landscape of financial transactions. In this blog, we delve into how naztech is utilizing blockchain to ensure secure financial transactions, bringing trust and innovation to the forefront of the Fintech Industry.

The Power of Blockchain:

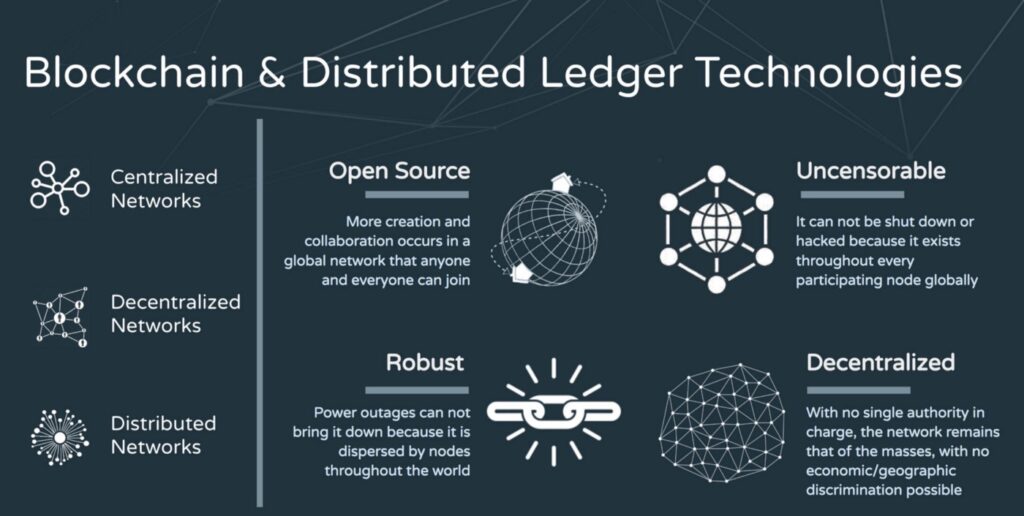

Blockchain is often described as a digital ledger that records transactions across multiple computers, providing an immutable and transparent record of every action it takes into the blockchain network. Its decentralized nature eliminates the need for intermediaries, further reducing costs and expediting the transaction processes. For financial transactions, this means quicker settlements, reduced fraud activity, and enhanced security on global financial transactions.

naztech’s Approach to Blockchain in Finance:

At naztech, we understand that the financial sector demands a foolproof security framework. Our secured blockchain solutions empower financial institutions with a tamper-proof record of transactions, ensuring that every step of digital transaction is verifiable and irreversible. By implementing smart contracts on the blockchain, we automate contractual agreements, streamlining processes and minimizing human errors that empower secure mass transaction by using computer networks.

Enhancing Transaction Security:

Security is vital in financial transactions. With blockchain’s cryptographic encryption, data becomes virtually impossible to alter, ensuring that sensitive financial information remains confidential among the transactional ends. By utilizing private and permissioned blockchain networks, naztech ensures that only authorized parties have access to critical data, thus mitigating risks associated with data breaches while transacting.

Transparency and Traceability:

Blockchain’s transparency empowers all parties involved to track transactions in real time. In complex financial ecosystems, this traceability fosters accountability and prevents fraud. Our blockchain-enabled solutions provide stakeholders with a complete audit trail, enhancing regulatory compliance and simplifying audits. Therefore, real-time transaction transparency and traceability are achieved.

Trust and Fraud Prevention:

Fraudulent activities can create severe consequences in the financial sector. By leveraging blockchain’s consensus mechanisms, we maintain a single version of truth that’s agreed upon by all participants. This consensus model not only prevents double-spending but also establishes a high level of trust among parties, making fraud nearly impossible. At naztech we embrace the power of blockchain shared ledger that prevents fraud and ensures trust in our Blockchain enabled Fintech Solutions.

List Some Use Cases of Blockchain Technology-Enabled Modern Fintech Solutions

Blockchain technology has the potential to revolutionize the fintech industry by providing secure, transparent, and efficient solutions. Here are some notable use cases of blockchain technology-enabled modern fintech solutions:

- Cryptocurrencies and Digital Assets: Blockchain is the foundation of cryptocurrencies like Bitcoin and Ethereum. These digital currencies enable peer-to-peer transactions, international remittances, and investments without the need for traditional financial intermediaries.

- Smart Contracts: Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They automate and enforce the execution of contracts, reducing the need for intermediaries in various industries, including insurance, real estate, and supply chain management.

- Cross-Border Payments: Blockchain enables faster and cheaper cross-border payments. Fintech companies are leveraging blockchain to streamline the process, reducing settlement times and transaction costs for international remittances and trade finance.

- Identity Verification and KYC: Blockchain can enhance identity verification and Know Your Customer (KYC) processes. Users can have more control over their personal data while providing necessary information to financial institutions securely.

- Supply Chain Finance: Blockchain enhances transparency and traceability in supply chains. It helps in verifying the authenticity of products and streamlining supply chain financing, reducing fraud and errors.

- Digital Lending: Blockchain-based lending platforms allow peer-to-peer lending without traditional banks. These platforms use blockchain to record and verify loan transactions and creditworthiness.

- Remittances: Immigrants and expatriates can send money back to their home countries more efficiently using blockchain-based remittance services, which often offer lower fees than traditional remittance providers.

- Regulatory Compliance: Blockchain can assist in automating regulatory compliance processes. It can provide real-time auditing and reporting capabilities, reducing the cost and complexity of compliance for financial institutions.

A Glimpse into the Future:

The adoption of blockchain in the finance sector is going to transform traditional banking models. SWIFT the most popular financial transaction authority has the interbank messaging system and Chainlink (LINK), a provider of real-world data to blockchains, will be collaborating with dozens of financial institutions to test how they can connect with multiple blockchain networks. At naztech, we’re at the forefront of this transformation, developing tailored blockchain solutions that will enhance financial security, transparency, and efficiency. As technology continues to evolve, we can foresee a future where financial transactions are not only secure but also seamless and accessible to all.

Conclusion:

In today’s ever-busy financial world, financial transactions are becoming increasingly digital. Security and trust are vital for reliable and faster financial transactions. Our pioneering approach to utilizing blockchain technology in creating secure Fintech solutions is unlocking the opportunities of data potential, and redefining the way financial transactions are conducted. With our expertise and innovative Fintech solutions, we are confident to reshape the financial landscape that enhances transaction security through the use of dependable blockchain technology.

Comment (1)

zoritoler imol

Pretty nice post. I just stumbled upon your weblog and wished to say that I’ve really enjoyed browsing your blog posts. In any case I will be subscribing to your feed and I hope you write again soon!