The Rise of RegTech: How naztech Fintech Solutions Ensure Compliance with xSCREEN and xTRANSACT?

The Rise of RegTech: How naztech Fintech Solutions Ensure Compliance with xSCREEN and xTRANSACT?

The financial technology space is evolving, where Regulatory Technology, or RegTech, has emerged as a helping tool in ensuring compliance, mitigating risks, and streamlining financial operations. naztech, the leader of Fintech innovation, takes pride in its cutting-edge RegTech solutions—xSCREEN and xTRANSACT. This blog explores the rise of RegTech and how naztech’s Fintech Solutions are dealing with compliance in the financial sector.

Understanding RegTech

RegTech refers to the use of technology to help financial institutions comply with regulations efficiently and at a lower cost. It leverages advanced tools such as artificial intelligence, machine learning, and data analytics to automate regulatory processes, monitor transactions, and ensure adherence to compliance standards.

naztech’s RegTech Solutions

naztech recognizes the key role of RegTech in the financial ecosystem and has developed state-of-the-art solutions to address the compliance needs of modern businesses.

xSCREEN:

Sanction Screening Redefined naztech’s xSCREEN is a robust sanction screening software designed to enhance due diligence and compliance processes. Leveraging advanced algorithms and real-time data analysis, xSCREEN efficiently screens transactions against global sanction lists. This not only ensures compliance with international regulations but also safeguards businesses from engaging in prohibited transactions.

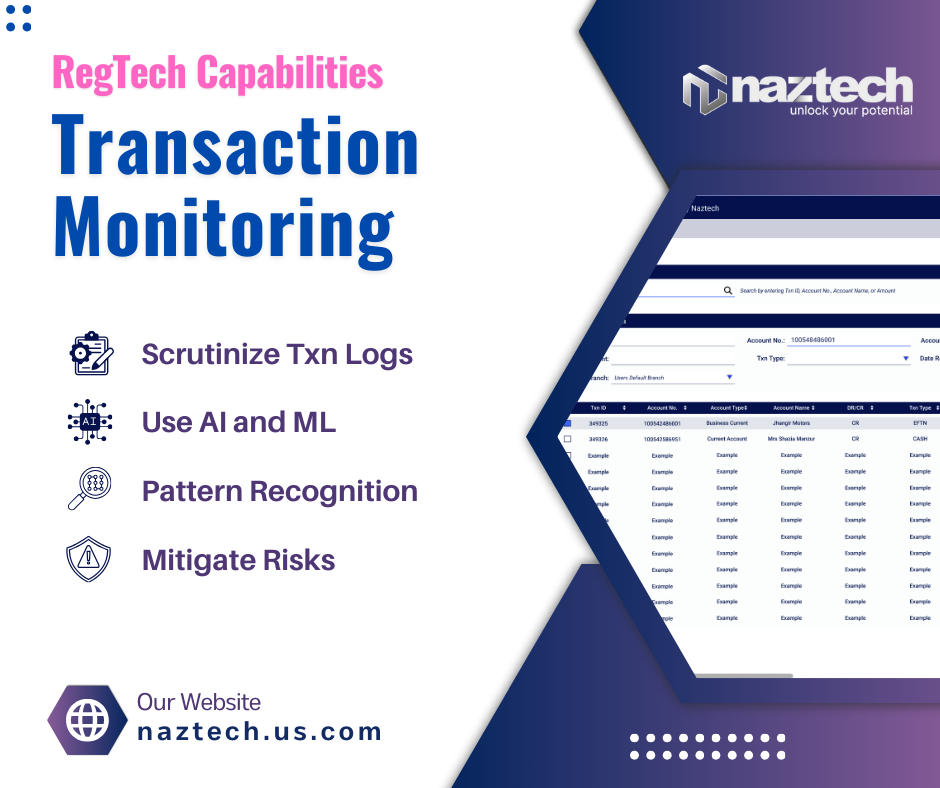

xTRANSACT:

This Intelligent Transaction Monitoring solution plays a vital role in ensuring error-free, seamless banking transactions. In the dynamic world of finance, monitoring transactions for unusual or suspicious activities is vital. naztech’s xTRANSACT, a sophisticated transaction monitoring software, employs RegTech capabilities to scrutinize transactions in real time. By utilizing machine learning and pattern recognition, xTRANSACT identifies anomalies, mitigates risks, and ensures secure financial activities align with regulatory standards.

Compliance Reinvented in naztech FinTech Solutions

naztech’s RegTech solutions goes beyond traditional compliance measures. They empower financial institutions to:

- Stay Ahead of Regulatory Changes: naztech’s RegTech solutions are designed to adapt swiftly to evolving regulatory spaces, ensuring that businesses stay compliant with the latest secure transaction standards.

- Enhance Operational Efficiency: By automating complex compliance processes, naztech’s RegTech solutions streamline operations, reduce manual errors, and free up valuable resources for strategic initiatives.

- Promote Trust and Transparency: With xSCREEN and xTRANSACT, naztech enables businesses to foster trust among stakeholders by demonstrating a commitment to transparency, ethical practices, and regulatory compliance.

End Words

As regulatory requirements are getting more complex day by day, naztech remains committed to providing innovative RegTech solutions that redefine compliance in the financial sector. The rise of RegTech is not just a technological advancement; it is a testament to naztech’s dedication to shaping the future of Fintech with cutting-edge, compliance-driven solutions. Stay compliant, stay secure—choose naztech for RegTech excellence.