AI and Modern FinTech Solutions are Revolutionizing the Financial Transaction Sector

AI and Modern FinTech Solutions are Revolutionizing the Financial Transaction Sector

Introduction

In the ever-evolving world of finance, staying competitive is not just an option; it’s a necessity. Modern financial institutions face a complex environment with stiff regulations, the demand for real-time data analysis, and the need to provide customers with personalized, efficient services. Artificial Intelligence (AI), enters as a game-changer in the world of FinTech. This blog explores the profound impact of AI that brings on modern FinTech solutions, its benefits, and real-world applications.

The Role of AI in FinTech

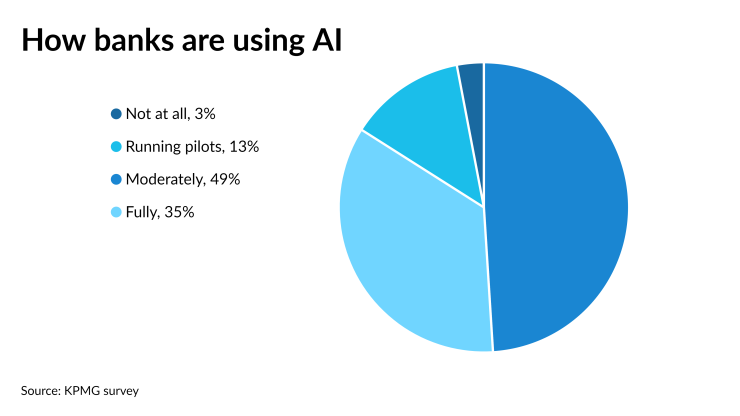

Artificial Intelligence, often referred to as AI, is a technology that empowers machines to simulate human-like intelligence. In the context of FinTech, AI is a catalyst for innovation and disruption. It’s transforming traditional financial services into something more efficient, secure, and customer-centric systems.

Enhancing Fraud Detection and Security

One of the high-priority challenges in finance is security. Traditional security systems are often reactive, identifying fraudulent activities after they’ve occurred. AI, with its predictive capabilities, empowers FinTech companies to detect potential threats in real time. It employs machine learning algorithms to identify unusual patterns, thus providing a more proactive approach to fraud detection. naztech brought to you AI-enabled modern Sanction Screening and Transaction Monitoring systems for local and global banks and financial service providers.

Personalized Services

AI-driven algorithms analyze vast amounts of customer data to provide tailored financial solutions. For example, AI can be used to recommend investment options, e-KYC Profiling, insurance plans, or loans based on an individual’s financial history and goals. Personalized services not only enhance the customer experience but also improve cross-selling opportunities for financial institutions.

Robo-Advisors

Robo-advisors are AI-driven tools that automate financial and investment advice. These systems analyze market trends, risk tolerance, and investment goals to provide recommendations. They operate 24/7, ensuring that investments align with market dynamics and customer preferences.

Credit Scoring

Traditional credit scoring models are often limited in scope. AI enhances these models by considering a broader array of data. Now, lenders can assess creditworthiness not only based on historical financial records but also by evaluating social media activity, spending behavior, and more. This opens doors to individuals who may not have a traditional credit history.

Real-World Applications

- Payment Processing: AI streamlines payment processing by automating transaction categorization and fraud detection.

- Chatbots: AI-driven chatbots offer customer support, answer queries, and guide users through various financial processes.

- Algorithmic Trading: AI algorithms analyze vast trade market datasets, identifying trends, and executing trades more efficiently than human traders.

Conclusion

The use of AI in modern FinTech solutions is now a trend. This technology enables the financial sector to provide more secure, efficient, and personalized services. As the financial industry continues to mature, embracing AI is not just an option; it’s a strategic imperative. Financial institutions that welcome the power of AI in their operations are more likely to lead the way in this era of digital technological advancement. AI has indeed cemented its place as the cornerstone of the FinTech revolution, and its influence is only set to grow.