Importance of Sanction Screening Software in Bangladesh in Perspective of naztech’s nScreening

Importance of Sanction Screening Software in Bangladesh in Perspective of naztech’s nScreening

Overview of Sanction Screening Software in Perspective of naztech’s nScreening

In the landscape of global finance, regulatory compliance stands as a cornerstone, supporting the integrity of financial transactions. Bangladesh, declaring this commitment to compliance, has prioritized the implementation of Automated Sanction Screening for new accounts and all international payments by its Member Banks, aligning with the directives of the Central Bank.

The Evolution of naztech’s nScreening Sanction Screening software

naztech’s nScreening Sanction Screening software solution emerges as an ideal of efficiency, designed to minimize the impact on business processes while ensuring robust compliance with regulatory frameworks. Let’s delve into the key features and business objectives that make nScreening an indispensable resource in navigating the complexities of financial compliance.

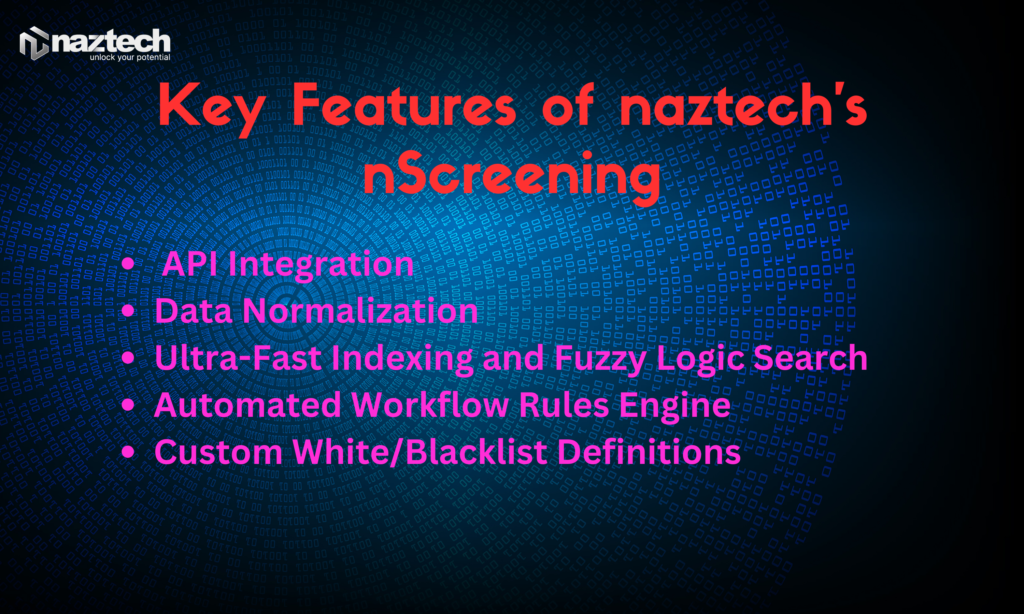

Key Features of naztech’s nScreening:

- API Integration:

- Seamless integration with CBS (Core Banking System), SWIFT, and remittance Management system.

- Ensures real-time synchronization and accuracy in data exchange.

- Data Normalization:

- Handles heterogeneous data sources by normalizing them into an organized format.

- Enables consistent screening across diverse data sets.

- Ultra-Fast Indexing and Fuzzy Logic Search:

- Employs advanced matching algorithms for rapid screening.

- Intelligently identifies potential matches with fuzzy logic search capabilities.

- Automated Workflow Rules Engine:

- Streamlines routing, approval, and authorization processes.

- Enhances efficiency through intelligent automation.

- Custom White/Blacklist Definitions:

- Tailors screening criteria to align with specific business needs.

- Offers flexibility in defining and managing lists.

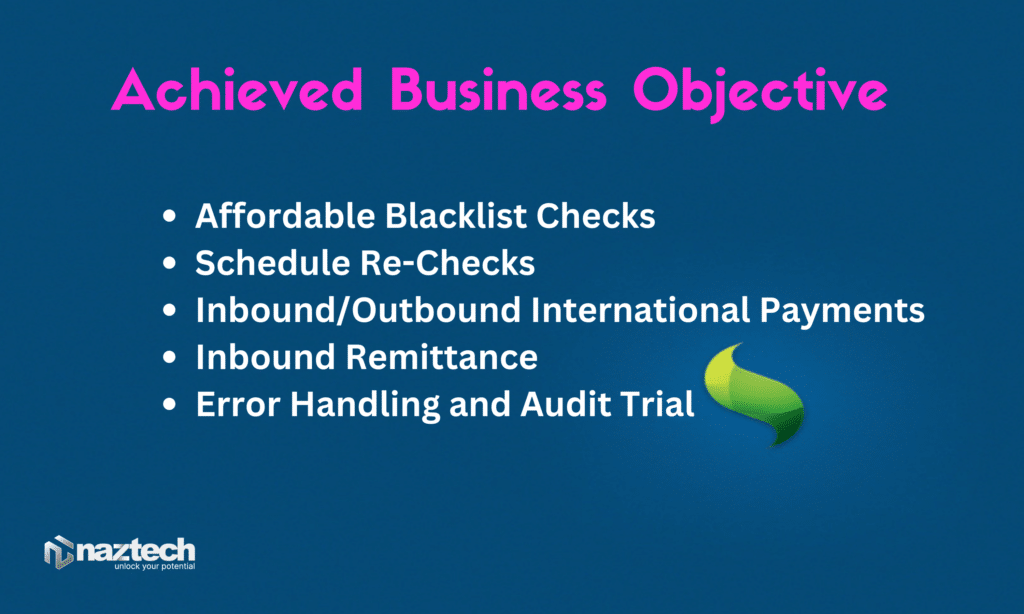

Business Objectives Achieved by naztech’s nScreening sanction screening software:

- Affordable Blacklist Checks:

- Ensures cost-effective screening for new customer accounts.

- Facilitates compliance without imposing unnecessary financial burdens.

- Scheduled Re-Checks:

- Establishes regular screening intervals for existing accounts.

- Ensures ongoing compliance with evolving regulatory standards.

- Inbound/Outbound International Payments:

- Safeguards international transactions from potential compliance risks.

- Enables secure and compliant cross-border financial operations.

- Inbound Remittance:

- Provides a seamless process for screening incoming remittances.

- Enhances transparency and compliance in remittance management.

- Error Handling and Audit Trail:

- Gracefully handles typos and transposition errors in screening.

- Maintains a comprehensive audit trail for all matches and non-matches.

Realized Results and Benefits:

- Legal & Regulatory Compliance:

- Ensures full compliance with the regulatory directives of Bangladesh Bank.

- Mitigates legal risks associated with non-compliance.

- Seamless Integration:

- Integrates seamlessly with all core systems, ensuring holistic compliance.

- Minimizes disruptions to existing workflows.

- Efficient Workflow Management:

- Streamlines the management of Blacklist ‘hits’ with automated workflows.

- Enhances efficiency in handling compliance alerts.

- Audit Trail and Transparent Reporting:

- Provides a robust audit trail for Central Bank inquiries.

- Ensures transparent reporting for compliance-related queries.

- Real-Time KPI Dashboard:

- Assists workflows through a real-time Key Performance Indicator (KPI) dashboard.

- Enables proactive management of compliance metrics.

- Pre-notification of SLA Deadlines:

- Facilitates adherence to Service Level Agreements (SLAs) through timely notifications.

- Ensures proactive management of compliance timelines.

Conclusion

In conclusion, naztech’s nScreening stands as proof of the commitment to excellence in financial compliance. By intelligently screening global payments and financial transactions, nScreening empowers businesses in Bangladesh to navigate the evolving regulatory landscape seamlessly. It not only ensures legal and regulatory compliance for sanction screening in Bangladesh but also enhances operational efficiency, thereby fostering a robust and compliant financial ecosystem.