Apache Kafka: The Next Big Game Changer in Fintech Service Industry

Apache Kafka gets a lot of attention from the Fintech developers, which brings new light to digital financial services. Success in the financial service industry depends on how well we transform the traditional business process with the latest technology to create new values. Leveraging the boring and repeated manual work process through technology is the main focus of this digital evolution. Latest digital technologies like AI, Machine Learning, web scraping, and data streaming transform the traditional banks to develop a new level of customer engagement and operational efficiency that was unimaginable a few years ago. Apache Kafka is one such disruptive data processing technology that can be applied intelligently around existing financial systems and processes to build more efficient, cost-effective, and customer-engaging banking and financial solutions.

Migration to Apache Kafka is already started by the financial service industry and implementing real-time financial applications into a broad range of use cases. This article highlighted the capabilities of Kafka’s data streaming that transforms traditional banking services to achieve a new digital ecosystem.

What is Apache Kafka?

Apache Kafka is a distributed event streaming platform used for high-performance data pipelines, streaming analytics, data integration, and mission-critical data communication applications. It is an open-source software platform developed by the renowned software foundation, Apache, and this platform was written in programming languages Scala and Java. Kafka was originally developed by LinkedIn in 2011 and has improved a lot since then.

How Kafka Process Messages?

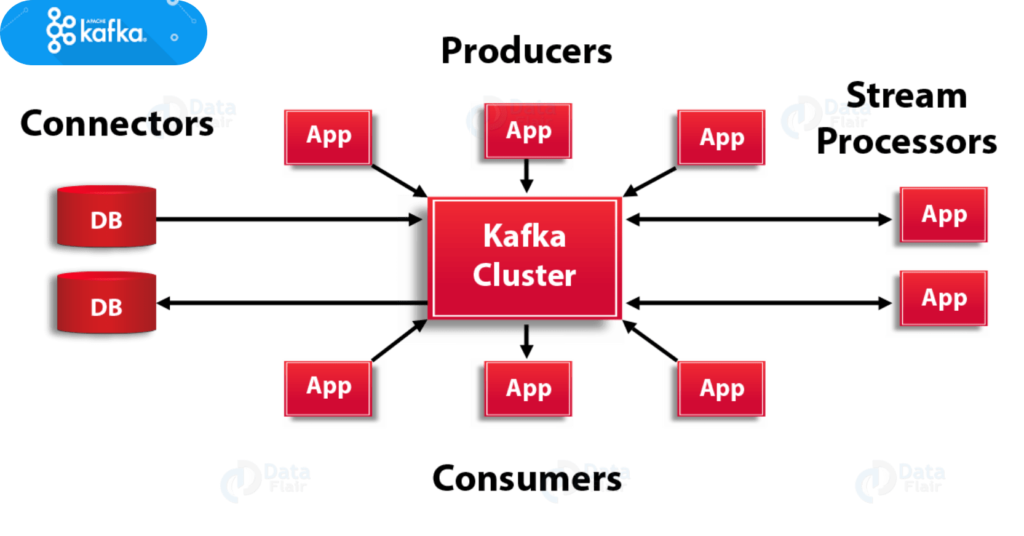

Kafka was designed to provide a unified, high-throughput, low-latency data exchange platform for handling real-time data feeds between systems. Kafka can connect many external systems for data exchange both import and export via Kafka Connect. It is known as Kafka streams, which is actually a Java stream processing library. In addition, Kafka uses a binary TCP-based communication protocol that is optimized for efficiency and relies on a “message set” abstraction. It simplifies the natural group’s messages together to reduce the overhead of the network round-trip by optimizing the larger network packets, larger sequential disk operations, and contiguous memory blocks. This process allows Kafka to turn a heterogeneous stream of random messages that writes into linear messages.

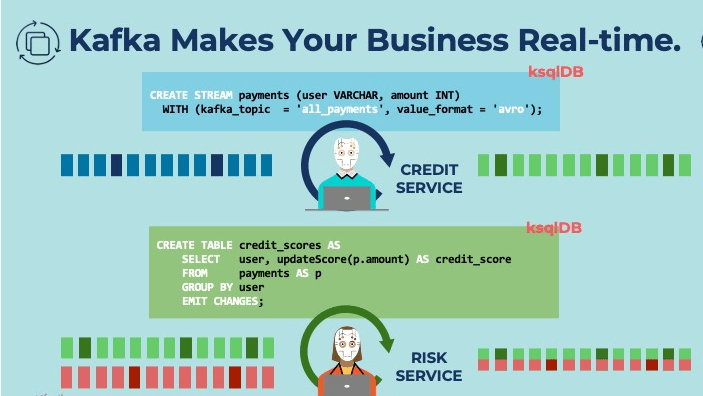

The Days of Night Long Batch Updating are Gone: Kafka Makes Your Business Transactions Real-Time

Kafka can process billions of transactions within a second. Kafka helps to develop real-time data pipelines to extract high-velocity high-volume data. These data are passed through a real-time pipeline of Kafka. So multiple systems can communicate data as a published, subscribed model using any streaming platform like Spark. Moreover, Kafka connectors like Node Rdkafka, Java Kafka connectors have similar data streaming capabilities. Now financial organizations can execute real-time data feeding and transaction processing to update the core banking system instantly. Therefore, no need for any scheduled batch update of the financial system. Moreover, the data that are subscribed can be pushed to the dashboard to view the analytics..

Why Modern Financial Solutions are Developed with Kafka?

Followings are the benefits of Kafka while developing cutting edge financial services:

- Kafka-enabled systems can handle large volumes of customer data with high reliability on multiple systems.

- Kafka is fault-tolerant and scalable which can be adjusted to increased demand.

- Kafka uses the distributed publish-subscribe messaging system, Kafka publish-subscribe messaging brokers are far more powerful than the other brokers like JMS, RabbitMQ, and AMQP.

- The platform can handle high-velocity real-time data, as a demand of modern internet banking.

- Kafka-enabled systems are also highly durable, as the data is persistent, it provides greater security.

- It can handle a high volume of messages with very low latency and increase customer experience on transactions.

Practical Use of Apache Kafka in Financial Services

At present more than 80% of Fortune 500 companies rely on Kafka-enabled systems. The use of event streaming in financial services is growing day by day. Continuous real-time data integration and processing are the necessities for present banking systems to keep the customers connected. Apache Kafka connects multiple financial services, business departments for mission-critical transaction systems and big data analytics. Performance KPI like high scalability, high reliability, and the elastic open infrastructure are the key reasons for the success of Kafka. In this article, we tried to give you, how Kafka explores different real-world examples, use cases, architectures in the Financial Service sector. Various practical use cases are emerging each day to deploy event streaming with Apache Kafka in the finance industry. Advanced mission-critical transactional systems like payment processing, transaction monitoring for AML, regulatory reporting, and big data analytics projects are implemented by using Kafka, AI, Machine Learning, data lakes, etc.

Final Words

Apache Kafka brings new opportunities for redesigning modern integrated banking solutions. It also gives us new light to rethink the capabilities of the traditional integrated banking model, which is under heavy stress for the demand of increased workload. Kafka-enabled systems, are reshaping the digital banking ecosystem and getting an advantage in customer financial transactions and communication. Succeeding in a digital banking ecosystem will require a new set of performance scaling capabilities on high-demand servicing, Kafka is providing exactly that. For these reasons, Apache Kafka is considered as the next big game-changer in Fintech Service Industry for developing advanced transactional and messaging systems. This will help organizations to be competitive and stay ahead.

Comments (5)

zoritoler imol

I dugg some of you post as I cerebrated they were very useful invaluable

PU Bag

Thanks for sharing, this is a fantastic article. Will read on…

biyapay是什么

Wow, great blog article.Thanks Again. Want more.

china Dropshipping

This is one awesome blog article.Much thanks again. Really Great.

linkinlove

Really enjoyed this article.Thanks Again. Much obliged.